Offshore banking brings with it a number of undeniable advantages. As a result, an increasing number of individuals are turning to offshore banks to hold, maintain, grow and protect their wealth. However, it can be easy to feel overwhelmed by the enormous range of offshore banks to choose from.

Offshore banking brings with it a number of undeniable advantages. As a result, an increasing number of individuals are turning to offshore banks to hold, maintain, grow and protect their wealth. However, it can be easy to feel overwhelmed by the enormous range of offshore banks to choose from.1. Confirm the Availability of Online Banking Service

One of the first things to evaluate when choosing a new offshore bank is whether the bank offers online banking services. In today’s modern world, this is a mandatory element to financial matters.

2. Consider the Bank’s Location

Although a bank may be offshore, it will still be located within a specific jurisdiction, or country. Every jurisdiction has its own regulations with regard to taxation, income reporting, protection and legal seizures.

3. Question Staff and Communication

It is absolutely fine to ask bank staff serious questions about how they communicate with customers. To start, ensure that most or all of the personnel working on behalf of the bank can communicate with you in your preferred language. In addition, find out what kind of credentials the bank’s financial experts have.

4. Ask About Reserve Requirements

Reserve requirements are the amount of liquid assets the bank keeps on hand in order to guarantee safety of investment to those individuals who hold accounts.

5. Explore the Full Range of Services Offered

The final step to evaluating an offshore bank is looking at the types of services they offer. For individuals, top priorities might be checking accounts, savings accounts or trusts.

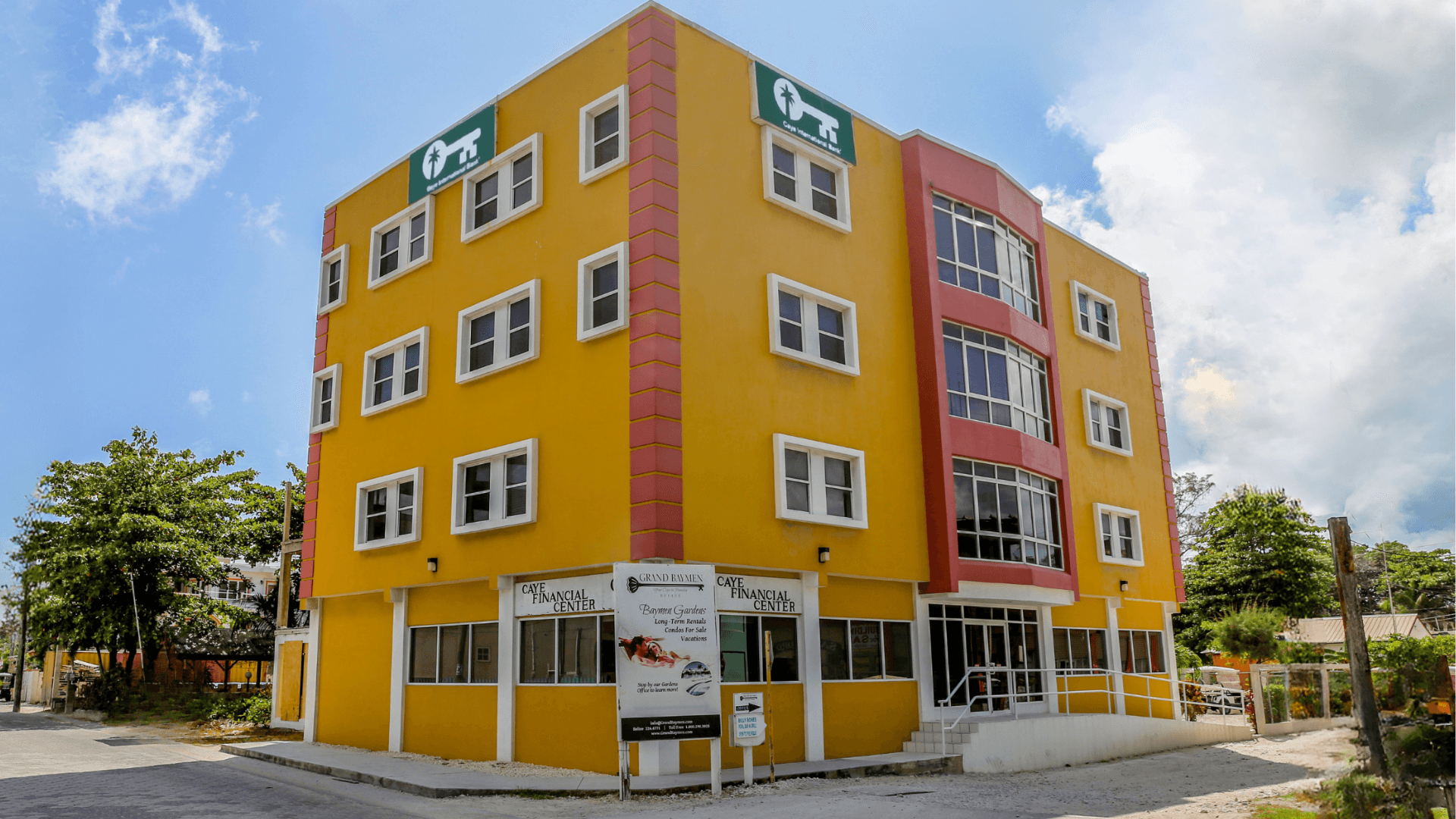

With these tips, it will be easier for you to evaluate offshore banks. After plenty of research, you might conclude that Caye International Bank in Belize is routinely chosen as the top offshore bank for individuals and businesses alike.