Why Correspondent Banking Is Being Rewritten and What It Means for International Clients in 2026

International banking rarely makes headlines when it works well. Funds move efficiently across borders, trade settles seamlessly, and global commerce continues without interruption. At the center of this system sits correspondent banking, a quiet but essential infrastructure that enables cross-border payments, foreign currency settlement, and global financial connectivity.

Today, that infrastructure is undergoing a structural rewrite. Correspondent banking is not disappearing, as some headlines suggest. Rather, it is becoming more selective, more disciplined, and more intentional. For international clients, understanding this shift is no longer optional. It is a prerequisite for banking effectively in 2026 and beyond.

The Quiet Backbone of Global Finance

Every international wire transfer relies on correspondent relationships. When a bank does not maintain a physical presence in a particular currency jurisdiction, it relies on another bank, a correspondent to process payments on its behalf.

This system has existed for decades and underpins everything from personal remittances to large-scale trade finance. Yet despite its importance, most clients interact with correspondent banking only when something goes wrong: a delayed transfer, additional questions, or an unexpected compliance request.

What has changed is not the relevance of correspondent banking, but the environment in which it operates.

Why De-Risking Happened and Why It Isn’t Reversing

Following the global financial crisis, regulatory expectations expanded significantly. Anti-money laundering, counter-terrorist financing, sanctions screening, and transaction monitoring standards rose across all major financial centers. At the same time, compliance costs increased sharply, while tolerance for risk declined.

For large global banks, correspondent banking became a business where:

- Compliance costs rose faster than revenue

- Reputational risk carried asymmetric consequences

- Smaller transaction volumes no longer justified exposure

The result was “de-risking”: a reduction in correspondent relationships, particularly with smaller banks, emerging markets, and jurisdictions perceived, fairly or not, as complex.

Importantly, this trend has stabilized, but it has not reversed. Global correspondent banks are not seeking volume; they are seeking quality. Relationships today are earned through transparency, governance, and consistency, not geography or history alone.

The Myth of “One-Size-Fits-All” International Banking

One of the most persistent misconceptions among international clients is that global banking access is uniform. In reality, correspondent banking has become highly segmented.

Two clients can hold accounts in the same jurisdiction and experience very different outcomes based on:

- Transaction behavior

- Clarity of source and use of funds

- Industry profile

- Documentation discipline

- Banking history

Similarly, two banks can operate under the same regulator but maintain vastly different correspondent access depending on their internal controls, risk culture, and relationship management.

This is why some international transactions now require additional information, staged processing, or longer settlement times. These are not arbitrary obstacles; they are manifestations of a system that now prioritizes understanding over speed.

What Strong International Banks Are Doing Differently

In response to this environment, resilient international banks have adapted in several key ways.

First, they invest heavily in compliance infrastructure, not as a defensive cost, but as a strategic asset. High-quality client onboarding, ongoing monitoring, and transaction transparency are essential to maintaining correspondent confidence.

Second, they diversify correspondent relationships. Relying on a single payment channel is no longer prudent. A diversified network improves resilience and reduces dependency risk.

Third, they engage proactively with correspondent partners. Relationship banking matters at the institutional level just as it does for clients. Open communication, responsiveness, and credibility are now decisive factors.

Finally, they educate their clients. Banks that succeed in this environment help clients understand expectations before transactions are initiated, reducing friction, delays, and frustration.

What This Means for International Clients in 2026

For international clients, the implications are clear and actionable.

Banking relationships matter more than ever. Choosing a bank should not be based solely on rates, speed claims, or marketing narratives. Institutional quality, governance, and correspondent depth directly affect your ability to move capital efficiently.

Documentation is no longer transactional, it is strategic. Clear explanations of business activity, source of funds, and transaction purpose are now part of normal international banking. Clients who prepare thoroughly experience smoother outcomes.

Transparency is an advantage, not a vulnerability. The global system increasingly rewards clients who communicate clearly and operate consistently. Opacity creates friction; clarity builds trust.

Expectations must be realistic. Same-day international settlement is not guaranteed in every corridor, currency, or transaction type. Planning liquidity and timing accordingly is part of modern financial management.

Most importantly, international clients should view their bank as a partner, not merely a service provider. Strong outcomes are built through cooperation, not confrontation.

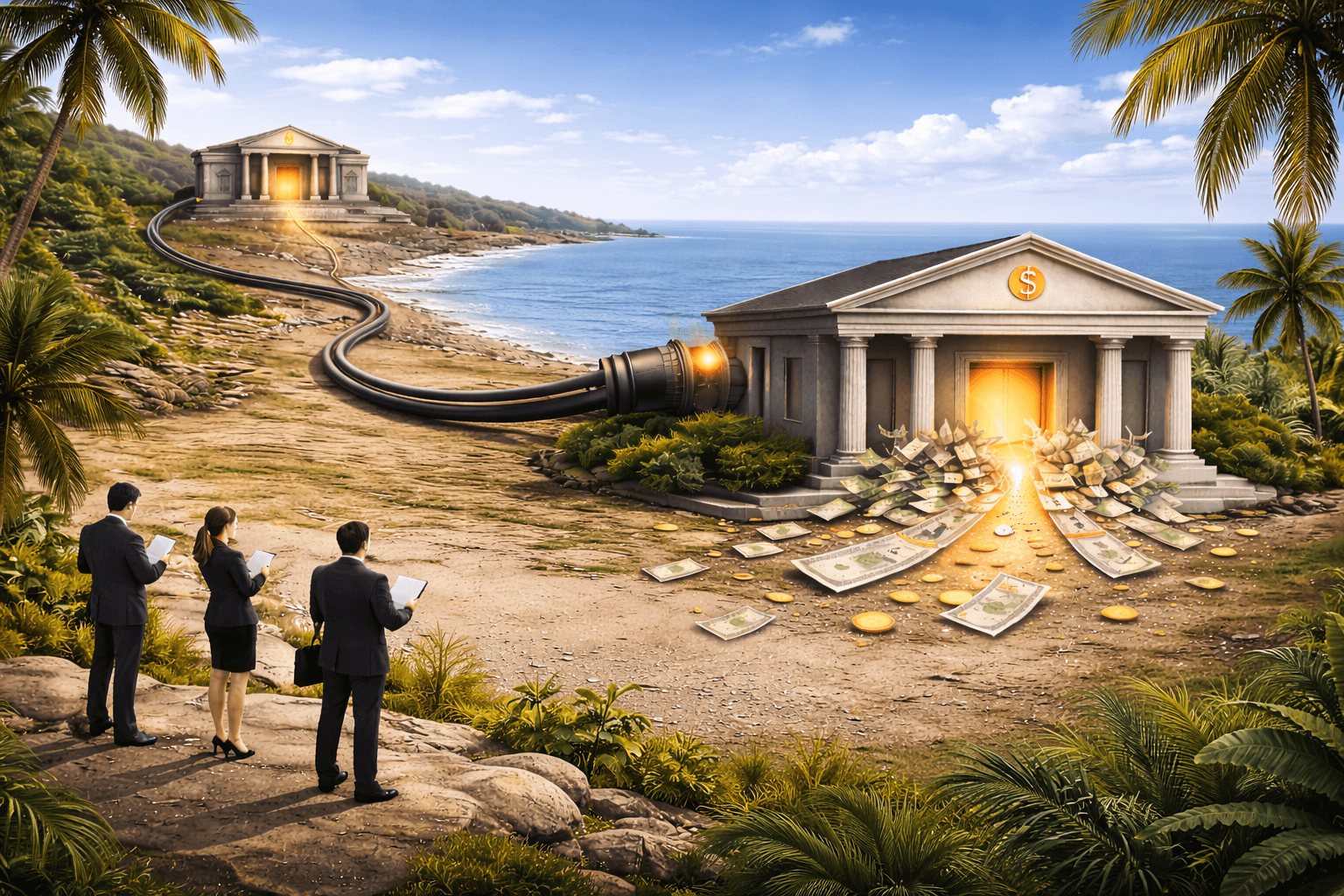

Correspondent Banking Is Not a Risk but a Filter

It is tempting to frame correspondent banking changes as a threat. In reality, they function as a filter that increasingly favors quality institutions and well-prepared clients.

Banks that invest in governance, compliance, and relationships continue to operate effectively. Clients who understand the system and adapt their approach experience stability and predictability, even as the global environment becomes more complex.

The future of international banking will not belong to those seeking shortcuts. It will belong to those who value structure, discipline, and long-term relationships.

As correspondent banking evolves, the clients who thrive will be those who evolve with it: informed, prepared, and aligned with institutions built for this new era of global finance.