Beyond the Dollar: Digital Integration as Central America’s Next Financial Lifeline

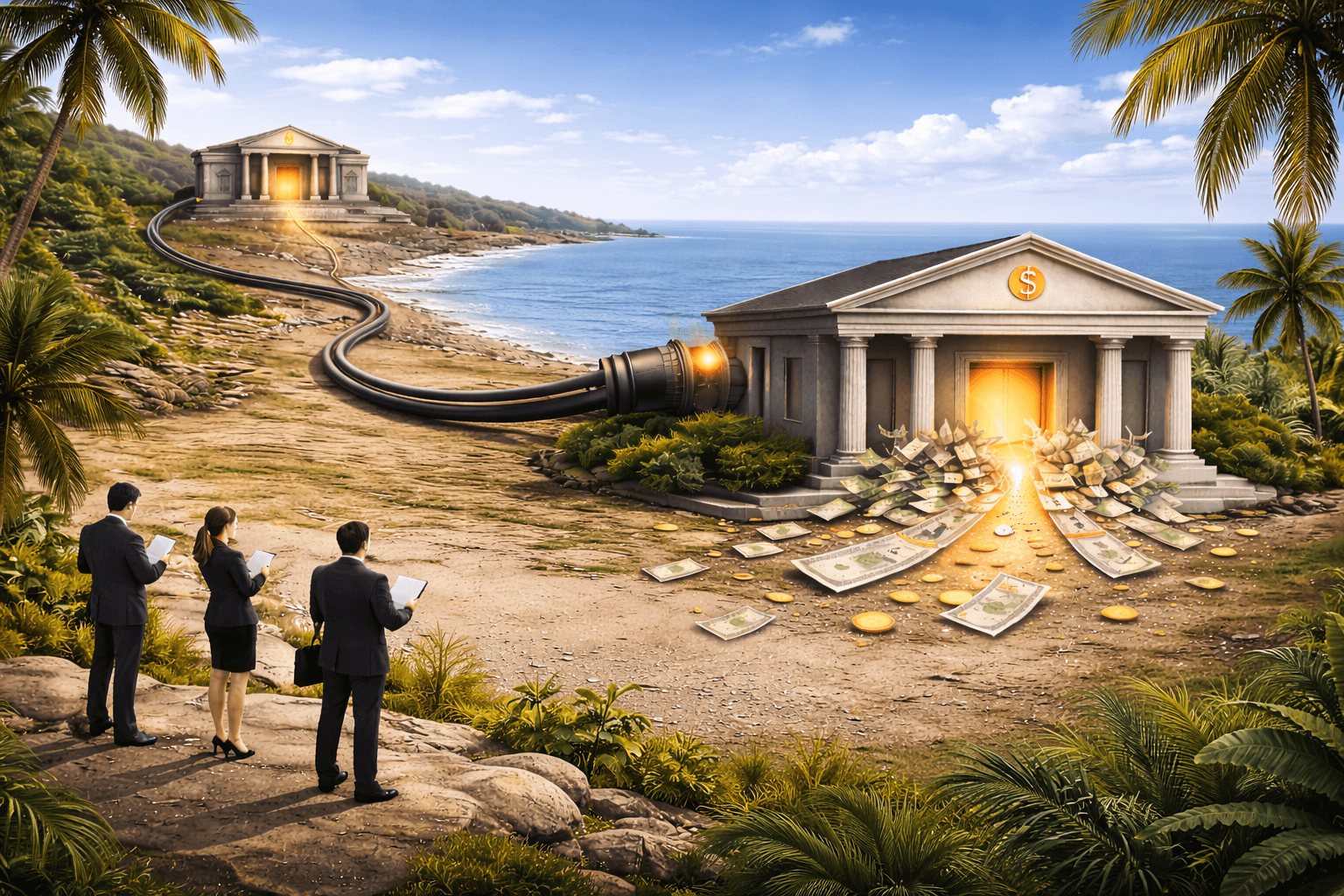

For decades, Central America’s financial stability has been precariously balanced on a structural fault line: dependence on the U.S. dollar and foreign correspondent banks. Each global crisis, whether the 1980s debt debacle, the 2008 financial meltdown, or the COVID-19 shock has exposed the same vulnerabilities. Banks suffer liquidity crunches, small businesses lose access to credit, and households reliant on remittances face painful uncertainty.

Yet beneath these recurring crises lies an opportunity. If Central America’s banking sector can pivot from reactive survival to proactive digital integration, the region has a rare chance to transform fragility into resilience. The coming decade will decide whether it seizes that opportunity or repeats its long history of externally triggered instability.

The Dollar Dilemma

The dollar has long been both Central America’s anchor and its shackle. On one hand, it delivers stability, credibility, and access to investment. On the other, it effectively imports U.S. monetary policy into economies that lack the buffers to absorb it. When the Federal Reserve raises rates, liquidity tightens in San Salvador and Tegucigalpa. When U.S. banks “de-risk” correspondent relationships, small lenders in Belize or Honduras can find themselves cut off overnight from the global payments system.

This dependence magnifies shocks. During the 2008 crisis, dollar scarcity meant that trade finance evaporated. In 2020, remittance channels were disrupted as U.S. unemployment spiked, exposing just how fragile household incomes were. Today, with U.S. regulatory scrutiny intensifying under FATF and FATCA regimes, many Central American banks are again at the mercy of compliance decisions made in New York or Washington.

The lesson is clear: monetary sovereignty is not an abstract concept it is the difference between having tools to manage a crisis and waiting helplessly for someone else’s central bank to act.

The Digital Imperative

If the region is trapped by dollar dependence, its escape route lies in technology. Digital transformation is not simply about modern apps or slicker customer interfaces. It is existential.

Costa Rica’s SINPE Móvil demonstrates what’s possible when digital infrastructure is paired with regulatory support. By allowing instant, low-cost transfers using only a mobile number, it has brought millions into the formal financial system and provided resilience during crises. In contrast, countries like Nicaragua and Honduras still reliant on legacy IT systems and fragmented regulations, saw much sharper disruptions when COVID-19 closed branches and forced services online.

Digital banking is not a luxury; it is the new backbone of financial resilience. From AI-driven risk management to mobile-first payment systems, the ability to adapt quickly during shocks will determine which banks survive the next crisis.

Stablecoins and CBDCs: Risks and Rewards

The global debate around stablecoins and central bank digital currencies (CBDCs) often feels theoretical. For Central America, it is immediate and practical.

Stablecoins could cut the cost of remittances, still hovering around 5-6% almost overnight. For countries where remittances account for 20% or more of GDP, the impact on household welfare and banking liquidity would be transformative. Unlike Bitcoin’s volatility as El Salvador has painfully learned, fiat-backed stablecoins offer predictability, speed, and efficiency.

CBDCs, meanwhile, represent a longer-term bet on sovereignty. By issuing programmable digital currencies, central banks could reclaim monetary policy tools eroded by dollarization, while simultaneously modernizing payment rails. Costa Rica, with its advanced digital infrastructure and regulatory maturity, is an obvious candidate to pilot such an initiative for the region. If successful, it could offer a blueprint for neighboring economies to follow.

But both innovations carry risks: cybersecurity threats, regulatory arbitrage, and social trust deficits. Without strong governance and clear frameworks, digital currencies could deepen rather than reduce instability.

Financial Inclusion: The Forgotten Frontline

Amid talk of Basel III compliance and capital buffers, it is easy to forget who suffers most during banking crises. My research shows that households and SMEs consistently bear the heaviest burden. Deposit freezes, credit rationing, and remittance costs disproportionately hurt low-income families and small businesses the very groups banks should serve.

Digital tools can change this calculus. Mobile wallets, agent networks, and interoperable payment systems can democratize access to finance, bringing informal savers into the formal economy and creating buffers against external shocks. Kenya’s M-PESA is the best-known example, but its lessons are directly applicable to Central America. By using ubiquitous mobile phones to provide savings, credit, and payment services, it transformed financial inclusion from a development slogan into an economic reality.

Central America’s digital revolution will succeed only if it is inclusive. Otherwise, digitization risks entrenching a two-tiered system: high-tech services for urban elites, and continued exclusion for rural and informal economies.

Governance and Trust: The Human Factor

Technology alone will not save Central America’s banks. Crises are as much about confidence as they are about capital adequacy ratios. If depositors believe their money is safe, panic is contained. If they doubt institutions, contagion spreads faster than liquidity injections can respond.

This is where governance matters. Weak supervision, corruption, and inconsistent enforcement remain endemic in parts of the region. Without credible regulators and transparent institutions, even the best digital tools will falter. As my recent discussion with regional experts confirmed, the absence of supranational supervision is perceived as one of the biggest vulnerabilities in Central America’s financial system.

Trust cannot be imported. It must be built through consistent enforcement, clear communication, and transparent resolution frameworks. Deposit insurance must be credible, crisis simulations must be public, and regulators must be insulated from political interference.

Toward a Regional Payment Future

If there is one reform that could fundamentally alter Central America’s trajectory, it is the creation of a regional cross-border payment system.

The Caribbean is already piloting such an initiative, designed to reduce reliance on U.S. correspondent banks. For Central America, the case is even stronger. Remittance costs could fall, intraregional trade could expand, and liquidity could circulate within the region rather than leaking abroad.

Existing platforms such as: El Salvador’s Transfer365, and Costa Rica’s SINPE Móvil provide a starting point. What is missing is the political will to knit them together under a regional authority such as the Central American Monetary Council. The economic rationale is undeniable. The geopolitical urgency is clear. What remains is leadership.

A Choice Between Resilience and Repetition

Central America stands at a crossroads. One path is familiar: continued dollar dependency, fragmented regulation, and recurring cycles of crisis. The other is harder but more hopeful: coordinated digital integration, inclusive financial innovation, and regional payment sovereignty.

The choice is not abstract. It will determine whether the next shock, geopolitical, technological, or climate-related, triggers yet another cycle of collapse and recovery, or whether Central America finally breaks the pattern.

The region’s banks, regulators, and policymakers have an opportunity to lead, not just follow. By embracing digital transformation, integrating ESG principles, and pursuing bold regional initiatives, Central America can shift from being defined by crises to being defined by resilience.

As history shows, crises will come. The question is whether Central America will meet them with fragility or with foresight.