Offshore private banking was a major topic of interest in 2012. Now that the second decade of the new century is maturing into the teen years, offshore banking accounts are capturing the interest of financially-savvy people around the world. It wasn’t long ago that offshore private banking was thought of as an activity reserved to powerful corporations, the jet-setting crowd, the rich and famous, or high net worth individuals. Things have changed, however, and more people are now taking advantage of offshore banking services.

Offshore private banking was a major topic of interest in 2012. Now that the second decade of the new century is maturing into the teen years, offshore banking accounts are capturing the interest of financially-savvy people around the world. It wasn’t long ago that offshore private banking was thought of as an activity reserved to powerful corporations, the jet-setting crowd, the rich and famous, or high net worth individuals. Things have changed, however, and more people are now taking advantage of offshore banking services.

Why Offshore Private Banking is Becoming Popular

Globalization has expanded the financial goals of many people. Expatriate communities around the world are growing thanks to free trade agreements and the expansion of employment opportunities abroad. Until recently, expat banking mostly consisted of people who traveled abroad and hoped to see the same banks they used at home. This hope was often shattered by the reality that the banking presence was limited to a name and a logo.

Offshore private banking is different in the sense that it does not rely on a name or a familiar logo to attract financially-savvy account holders. One of the main reasons offshore private banking has become very popular over the years is that account holders enjoy better rates of return at considerably low risks. They are able to do this by complying with the laws and rules of the sovereign jurisdictions they are located in and not by trying to latch on to a relationship with a major bank in North America or Europe. They also truly care about their account holders and understand their need for privacy.

The Internet Makes Offshore Banking Easier

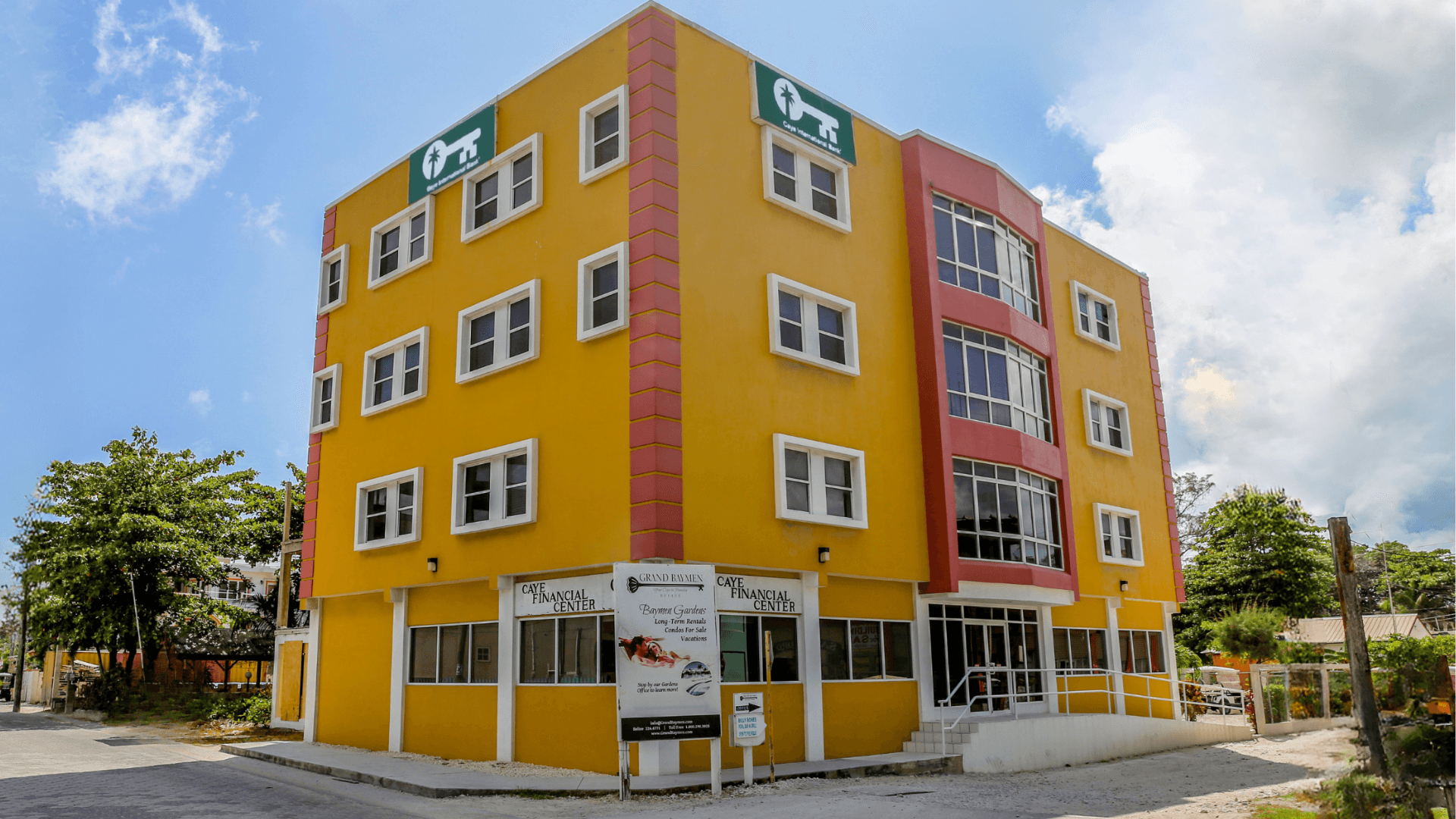

Offshore banking has also enjoyed greater popularity in recent years thanks to the growth of Internet technologies. Banks in Belize, for example, now offer checking, savings and investment accounts that can be managed completely online. Account holders are no longer required to travel abroad to open accounts; they can retain a specialized attorney to help them in this regard or else they can directly contact the financial institution and send in a few required documents.

Online account management tools, globally-accepted debit cards and the traditional tax advantages of offshore banking are additional benefits that account holders can enjoy. Offshore banks offer their clients various flexible methods of making deposits; withdrawals are handled through debit cards accepted in hundreds of thousands of automated teller machines (ATMs) around the world. These cards also allow account holders to make purchases and track their spending.

Offshore Private Banking in 2013

Banking analysts are forecasting that interest in the offshore banking systems of countries like Belize will continue to grow in 2013. There is some anxiety about the economies of North American and European nations and their future prospects, and there are also deep concerns about their changing laws and taxation measures.

In countries like Belize, however, the Ministry of Finance and Economic Development has not announced any drastic measures for the future. The government is expected to keep its policy of non-intervention in banking affairs out of respect for account holders, and this fact alone will guarantee that interest in their offshore banking opportunities will continue.